LBI Weekly Holdings and Income report - Week 12 - week ending 20 October 2024

Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI has just recently come under new management, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

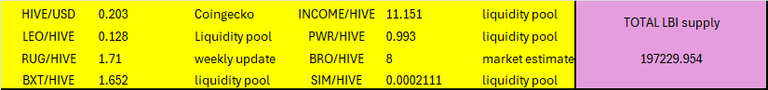

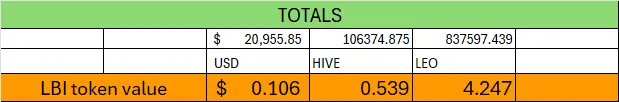

These are the token values used at the time of this report:

And here is the link to last weeks update for comparison:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-11-week-ending-13-october-2024-2kn

On with the update.

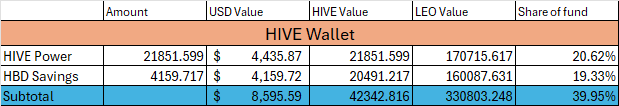

HIVE Wallet

60 HP added this week, which is our smallest number since taking over running LBI. Need to get more content out to get this growing a bit better.

I am feeling the urge to swap more HBD savings out to invest in HIVE and HIVE based positions. It feels like HIVE is starting to move, and I just feel that we can do better than 15% return on HBD. Was planning to put a post out over the weekend to discuss this possibility, but life got in the way. Will get a post out in the coming days.

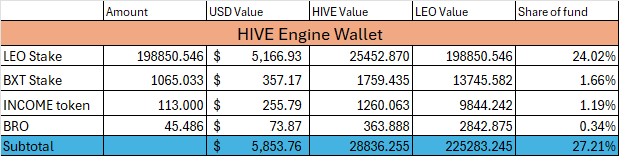

HIVE Engine Wallet

A nice, full week of leo.voter payouts this week, so we added 234 LEO to our stake. Only a small amount of BXT and BRO added over the week this time. I have been using spare funds to top up the PWR wallet, so these positions have not been growing much.

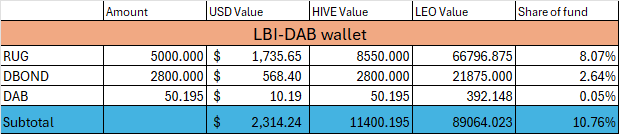

@lbi-dab wallet

Growth here this week. We got our DBOND drop a little late, and I sold some DAB to top up our overall income for the week. Still gained 50 DBOND and 5 DAB even after selling some out. This is one spot I'd add funds to if I did pull out HBD to HIVE. There is a bunch of DBOND on the market just over 1 HIVE each, and they would double our position and get the DAB flowing faster. Maybe - keep an eye out for the post about our HBD to have your say.

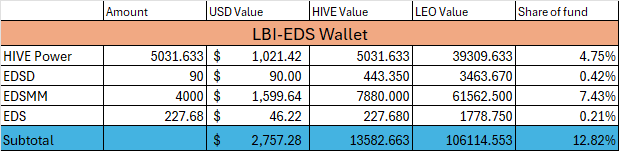

@lbi-eds wallet

Super reliable, and doing exactly as it is meant to. Grew by over 20 EDS for the week - nice and steady. I'd like more HIVE delegated to eds.vote, but I'd like more of everything really. I think we just let this one do its thing for a while.

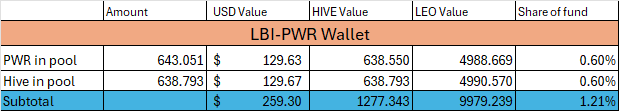

@lbi-pwr wallet

I've been sending whatever spare funds I can over here, on top of the built in growth. Overall, we have added around 50 HIVE value for the week to the position. Pool is still yielding over 20%. We pull half that yield out to the income account, and compound the rest. Would definitely add more funds here if I pull out the HBD.

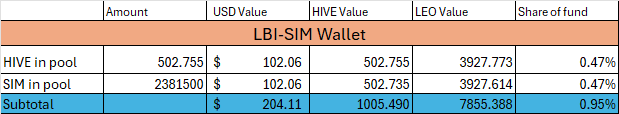

@lbi-sim wallet

Not doing a lot with this wallet for now. The position lost a little HIVE value with SIM dropping a bit over the week. Would like to build it up quicker, but it is just one of many options for us at the moment.

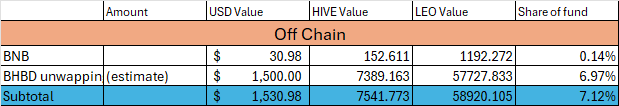

Off Chain.

No changes. Watch this space...

Totals

Small uptick un the USD value over the week, around $600 which is nice. HIVE value drops slightly, as HIVE is nudging higher. LEO value has also dropped a bit, which is not a bad thing as it means LEO itself is not going down. My focus is on the USD value at the end of the day, so I'd be happy for LEO and HIVE to go up. This is why I'm thinking to pull HBD out and swap to HIVE valued assets, because I think HIVE is likely to go up. HBD is a good hedge when HIVE is dropping, but slows down our gains when HIVE is on the rise.

Here is last weeks numbers for comparison.

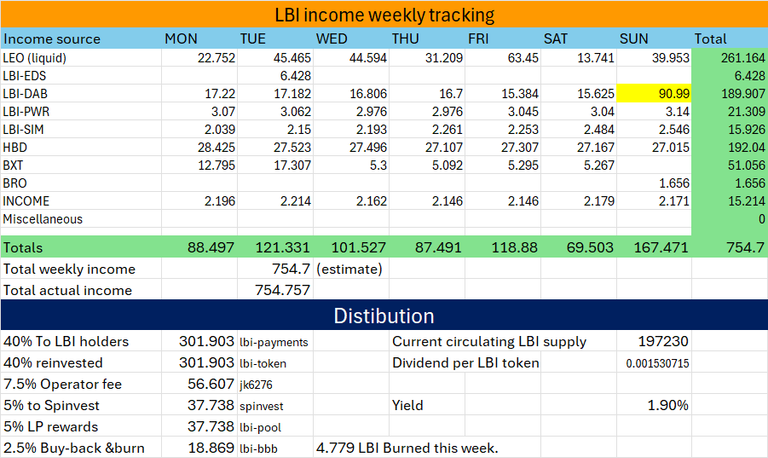

Income statement.

Income has not been growing as quickly as I would have liked. Some of our positions are slow burns, like the EDS, DAB and SIM wallets specifically. They hold a solid amount of assets, but the income growth takes time to gain momentum. Once again, I cheated a bit on Sunday to top up the income total so it is roughly matching last week. More content would help here. Our minor positions, INCOME, BRO and BXT are going ok.

4.779 LBI burned for the week.

That's about it for this weeks update. Stay tuned for the post discussing pulling HBD out. I know there will be mixed views about it, so I'll be looking forward to the feedback.

Cheers for now,

JK.

https://inleo.io/@lbi-token/lbis-september-2024-recap-2zc

https://inleo.io/@lbi-token/lbi-august-2024-recap-9vv

Posted Using InLeo Alpha

I think Hive should do better than HBD interest in the short term. It would be nice to get that bump and then trade back.

Yeah, that is my feeling, but I'm a terrible trader so I'm not keen to back my instincts. Will have a post out in a day or two.

I think you are still doing great. Just keep it up. We will get there!

Thanks mate - appreciate the support as always.

Please make a post and show us the numbers ;)

I will get there. I'll work up some numbers, and I know there is likely to be disagreement. I haven't done anything, and won't without a significant majority of support for the move.

Post will be out in 24 - 48 hours.

Hello lbi-token!

It's nice to let you know that your article will take 13th place.

Your post is among 15 Best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by polish.hive

You receive 🎖 0.3 unique LUBEST tokens as a reward. You can support Lu world and your curator, then he and you will receive 10x more of the winning token. There is a buyout offer waiting for him on the stock exchange. All you need to do is reblog Daily Report 459 with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by szejq

STOPor to resume write a wordSTART