Administrative Rule Changes for our ensemble

Ahhhh... the joys of running an ensemble! We have charity status finally... that particular box is ticked and we are properly registered. Which I had hoped would be a short administrative hop for the ACNC (Australian Charities and Non-Profits Commission) to refer us to the ATO (Australian Tax Office) for tax-exemptions due to being a cultural non-profit.

... and we are almost there, we just need to make some small additions to our incorporated associations constitution to be fully accepted.

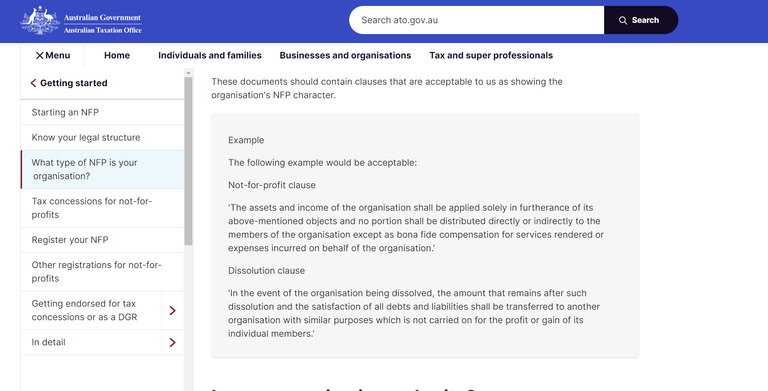

As you can see above, the two clauses relate to the not-for-profit and dissolution sections of the constitution. The model rules that we used did contain similar clauses, but they weren't tight enough for the tax-exemptions.... which is slightly annoying, but seeing as we are a small and tight outfit, it is no big deal in the end.

However, it does mean that we have some administrative hoops to jump through before we resubmit our amended constitution.

First step was to check the amendments that we needed to make.... these two clauses needed to be added, and some minor edits to fix some spelling mistakes in the original constitution. DONE!

Second, we needed to notify our membership with 21 days notice of a special resolutions meeting that would address these rules changes. The notification needed to specifically spell out the rule changes that would be voted upon and what their effect would be. Easy enough... tedious, but easy. DONE!

Then we would have to have that meeting... and then vote. There should be no problem, we have a tight membership and the rule changes are not controversial. After that, we need to send the minutes and the amended constitution to the ATO and then they will process our tax-exemptions.

Immediately afterwards, I will also have to notify the ACNC and the state government about the rule changes... and then pay the small fee for lodgment as well.

Sigh... lots of hoops to jump through, and it is a bit annoying to do seeing as we are musicians and not lawyers. But I'm sure that there are many organisations that are in similar positions and the governing bodies are pretty lenient on small organisations like us that are trying to do the right thing... it is mostly the big organisations that are really trying to game the system!

So... time to edit the constitution with the additional clauses to have it all ready for the special resolutions meeting!

Handy Crypto Tools

Ledger Nano S/X: Keep your crypto safe and offline with the leading hardware wallet provider. Not your keys, not your crypto!

Coinbase Wallet: Multi chain wallet with lots of opportunities to Learn and Earn!

Binance: My first choice of centralised exchange, featuring a wide variety of crypto and savings products.

WooX: The centralised version of WooFi. Stake WOO for fee-free trades and free withdrawals! This link also gives you back 25% of the commission.

GMX.io: Decentralised perpetual futures trading on Arbitrum!

Coinbase: If you need a regulated and safe environment to trade, this is the first exchange for most newcomers!

Crypto.com: Mixed feelings, but they have the BEST looking VISA debit card in existence! Seriously, it is beautiful!

CoinList: Access to early investor and crowdsale of vetted and reserached projects.

Cointracking: Automated or manual tracking of crypto for accounting and taxation reports.

KuCoin: I still use this exchange to take part in the Spotlight and Burning Drop launches.

MEXC: Accepts HIVE, and trades in most poopcoins! Join the casino!

ByBit: Leverage and spot trading, next Binance?

OkX: Again, another Binance contender?

Account banner by jimramones

Posted Using InLeo Alpha

Tons of fun aye!?

Yeah... lots and lots...

Ahh the joys of having to deal with beaurocratic bullshit when you just want to do your thing XD

Glad it seems like it was just tedious :)

Ah tell me about it... I can see why people just hire a staff. But I figure that it would cost more that way... and I can just see this as "earning" the wage that I would have paid out!

If you can hire staff to do it then I think that's a good indication that you're doing well XD

Though it was at that point that sibling dearest and I dipped on our business because we needed to restructure much more than either of us were willing to x_x

Ah yes... if we have the capacity to hire staff, I figure I would just pay myself for the work that I'm already doing!

Talk about a lot of government oversight and then some.... That sucks!

I guess it is really to stop people forming tax-dodging non-profits that don't actually do "charitable work"... annoying, and it does in the end feel like the people who are trying to comply have the most work, and those who are dodgy just wing it until they get caught (if they get caught...).